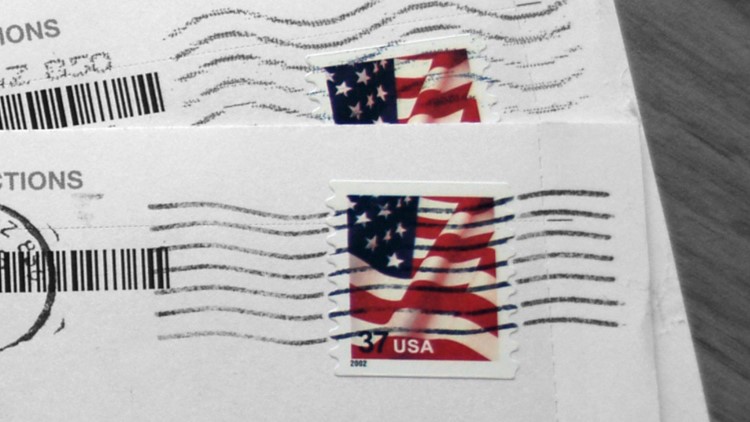

Pre-Canceled Stamp: Stamps sold through a private vendor, such as .Īutomated Postal Center Stamps: Stamps, with or without a date, purchased from machines located within a USPS lobby. Many private companies use these types of postage machines. Metered Mail: Mail on which postage is printed directly on an envelope or label by a postage machine licensed by the USPS. Your mailed payment must be received by the delinquency date to avoid penalties.) *POSTAGE THAT IS NOT POSTMARKED: (If you use these types of postage the USPS will not postmark your mail. Standard Postage Stamps: Stamps purchased and affixed to mail as evidence of the payment of postage. and 5 p.m., Monday through Friday, holidays excepted. Payments may also be made in person between the hours of 8 a.m. Looking for peace of mind when sending company emails that contain sensitive and private data Learn about Trustifis postmarked proof & tracking feature. The postmark is generally applied, either by machine or by hand, with cancelation bars to indicate that the postage cannot be reused. Payments must be postmarked before the delinquent date to avoid penalties.

Post marked code#

POSTMARKS are imprints on letters, flats, and parcels that show the name of the USPS Office that accepted custody of the mail, along with the state, zip code and date of mailing. Taxpayers who send their payments by mail are cautioned that the United States Postal Service (USPS) only postmarks certain mail depending on the type of postage used, and may not postmark mail on the same day it is deposited by a taxpayer.

If a payment is received after the delinquency date, with no postmark, the payment is considered late, and penalties will be imposed in accordance with State Law.

The Amador County Tax Collector's Office would like to remind taxpayers that property tax payments must be received or postmarked by the delinquency date to avoid penalties.

0 kommentar(er)

0 kommentar(er)